Over the past 6 months, US markets have posted their highest losses since the Great Depression. With the closing of America’s oldest banks and mortgage lenders such as Lehman Brothers, Fannie and Freddie, US markets have been plunging - with world markets now following suit. Analysts all over the globe are predicting a global recession, oil prices are dropping in reaction and millions of people will surely lose their jobs.

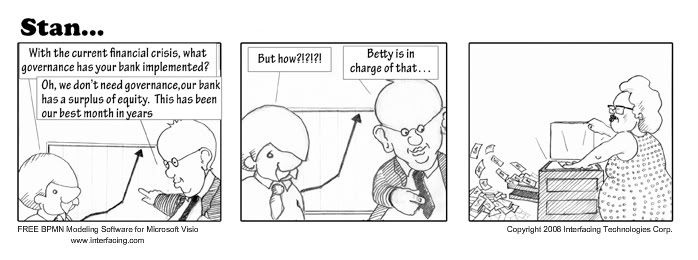

Although many people, including British PM Gordon Brown, have made light of the Financial Crisis with humour, it is no laughing matter.

So we come to the question – how did this ever happen? The US housing market has been the prime culprit for months now, over extending themselves with countless risky (and stupid) loans. And POP! the bubble bursts. It is the age old story of Bankers following a herd mentality and continuing their spending and lending sprees with few red flags being raised. Even Barack Obama wrote the Treasury Secretary warning him of the state of the housing market, but no one was listening.

As a BPM consultant I can’t help but point to BPM software as being the solution to the troubled US economy. Today, BPM software should be used to highlight and mitigate the risks associated with the tight fiscal budgets of banks. In order for banks, and virtually every business, to maintain their budgets BPM’s risk management, governance and compliance functions can be used. Setting controls and rules on company actions – in an automated workflow setting – will continuously and automatically monitor business behavior.

Although it may be a utopist view, I believe that this whole financial crisis could have been avoided if banks and corporations throughout the US had used BPM and Business Intelligence Software. If the major lenders in the US had used BPM and BI Software to assess risk, red flags would have been thrown up long before the problem surfaced. Seamlessly accessing credit information, income documentation and the like would have shown banks that these mortgages were high risk – and that so many high risk loans had been extended that it spells trouble. Running ‘what-if’ scenarios using BI and risk management software could have also predicted the number of defaulted or delinquent loans needed to bankrupt the banks. I guess that’s the future of web 2.0 – connectivity, a fully cooperative social network of businesses.

As Warren Buffet says “Bankers who act like lemmings are likely to experience a lemming-like fate”. BPM software that uses Governance Risk and Compliance (GRC) tools would lead lenders to think for themselves – not follow the herd. They would use raw data in order to make decisions instead of looking to their neighbours.

The financial crisis also points directly to the need for transparency and accountability, something which I have pointed to in the past.

A recent issue of the Economist contained a fitting quote by Teo Swee Lian, deputy managing director at the Monetary Authority of Singapore – their central bank. He said, “There are many lesson to be taken away from the crisis. These include the over-reliance of financial institutions on external ratings, [the need for] better oversight of banks’ off-balance-sheet exposures, the regulatory treatment of these exposures and the need to strengthen stress testing on financial institutions.”

Sounds like a recipe for BPM software to me…

1 comment:

Get some traction with these first and your success will help get buy-in when tackling larger processes that involve a wider user base with multiple stakeholders.

business process management software

Post a Comment